SMSF Trustee Structures:

Individual vs Corporate trustee

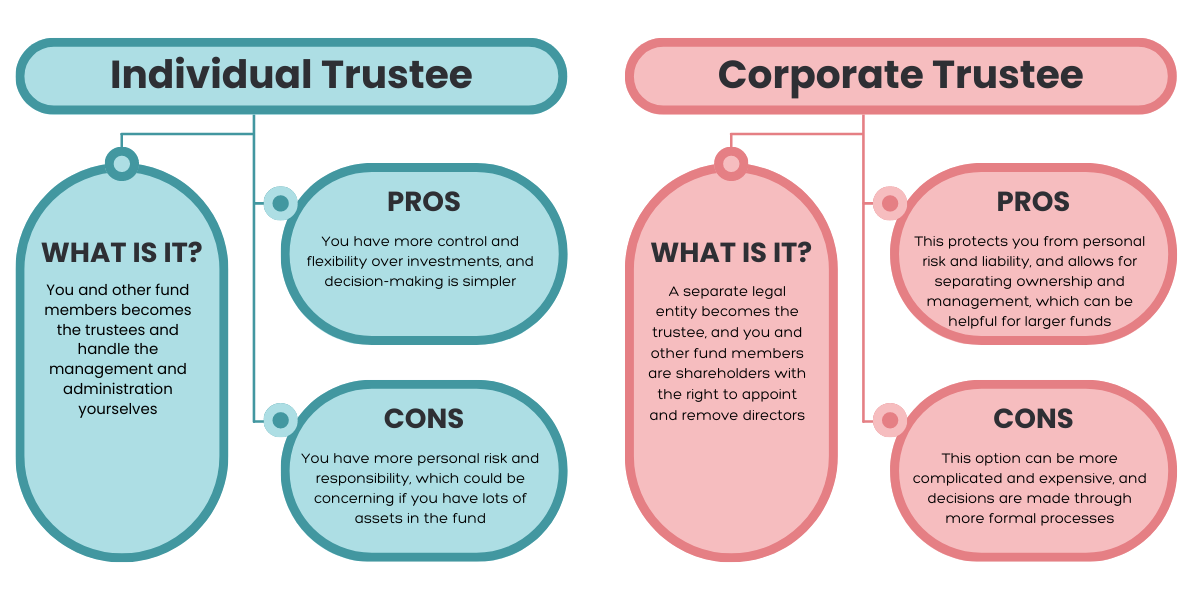

Self-Managed Superannuation Funds (SMSFs) can have either individual trustees or a corporate trustee structure. The trustee structure of an SMSF is an essential aspect that determines how the fund operates and makes decisions. Here’s an overview of the different SMSF trustee structures:

Individual Trustees

In this structure, all members of the SMSF act as trustees of the fund. The maximum number of members in an SMSF with individual trustees is six. Each member has an equal say in the decisions and administration of the fund.

Corporate Trustee

In this structure, a company is established to act as the trustee of the SMSF, and the members of the fund are the directors of the company. This structure is typically recommended for SMSFs with multiple members or when the fund plans to purchase property. With a corporate trustee, each member’s legal liability is limited to the amount of their investment in the SMSF, and any legal action taken against the SMSF is taken against the company rather than the individual members.

There are several advantages to having a corporate trustee structure for an SMSF, including:

-

Easier administration: It is easier to manage the SMSF with a corporate trustee, as it is a separate legal entity from the members.

-

Flexibility: It is easier to add or remove members with a corporate trustee structure.

-

Asset protection: The corporate trustee structure provides additional protection to the members’ personal assets.

-

Estate planning: The corporate trustee structure can help in the event of the death of a member, as the shares of the company can be transferred to a nominated beneficiary.

It is essential to choose the right trustee structure for your SMSF, as it will impact the management, administration, and legal obligations of the fund.

9

| Individual Trustee | Corporate Trustee | |

|---|---|---|

| SMSF Setup costs | $550 | $1,600 |

| Ongoing costs of Trustee (ASIC annual review fee) | $0 | $63 |

| One member only in the SMSF |  |

|

| Two members in the SMSF |  |

|

| Suitable for setup with 3 to 6 members |  |

|

| Quick SMSF setup process |  |

|

| Suitable for basic investments (cash, shares, managed funds) |  |

|

| Suitable for investment property purchase |  |

|

| Suitable for SMSF borrowing |  |

|

| Investments stay in the same name when members are changed |  |

|

| Easy to add/remove members |  |

|

| Liability protection for trustees |  |

|

| Ensures clean separation of assets between the SMSF and members |  |

|

| ATO administrative penalties if incurred – who is liable to pay | Each Trustee | Single Penalty |