SMSF Investments:

What can you invest your super in?

You’re in control! There are so many investment options for your SMSF

Types of SMSF investments

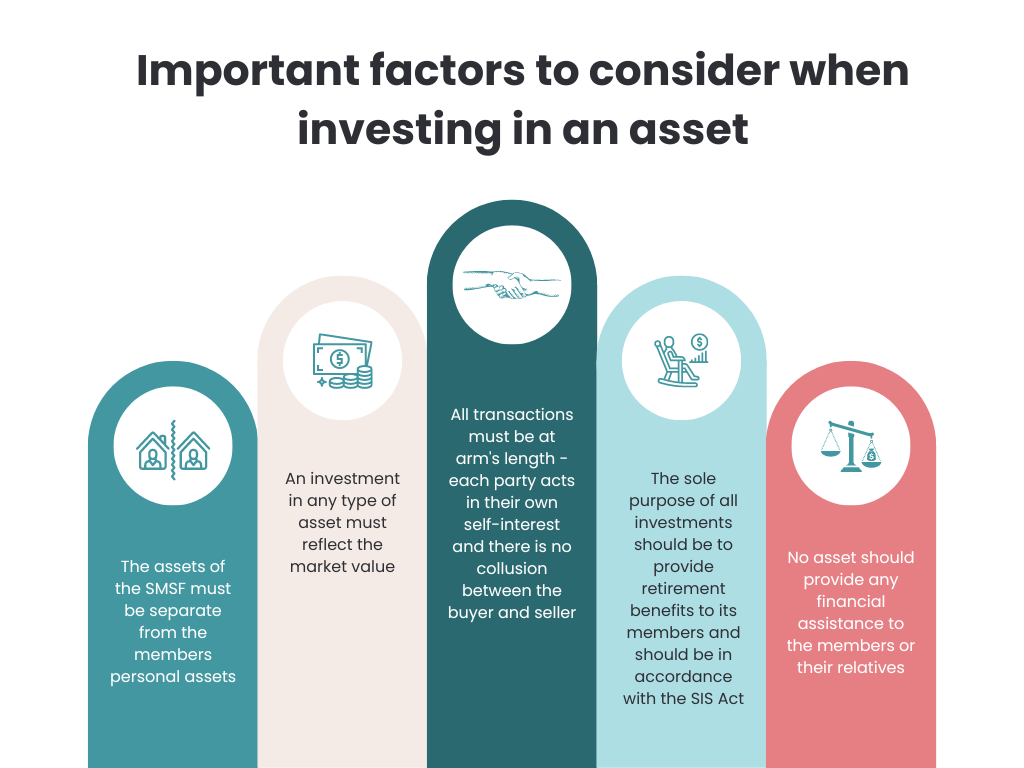

Self-managed superannuation funds offer a tonne of benefits to the members including total control over the investment choices. You can explore the various SMSF investment options available for your retirement savings. It’s important to develop an investment strategy for the SMSF which sets out the investment objectives and specifies the types of investments your fund will make.

An SMSF can invest in a wide range of assets. Here are some of the most popular assets our clients are investing in:

Cash

SMSFs can invest in cash-based assets such as bank accounts, term deposits, and cash management trusts. These types of investments provide liquidity and a source of income for the fund.

Shares

SMSFs can invest in shares listed on the Australian Securities Exchange (ASX) or other exchanges. This can provide the fund with exposure to a wide range of companies and industries, and the potential for capital growth.

Property

SMSFs can invest in residential and commercial property, either directly by purchasing a property or indirectly through property trusts. Property can potentially provide a long-term source of income and capital growth.

Other potential SMSF investment options

Australian Shares

International Shares

Residential or Commercial property

Cash

Term deposits

Bonds

Physical commodities

Collectables

Managed Funds

Cryptocurrency

Business – non-related parties

Loans to non-related parties