SMSF Loans

Maximize your SMSF’s potential by borrowing money to finance an investment property.

Wondering if an SMSF loan is right for you?

Investing in a property through your self-managed super fund (SMSF) can offer great rewards, but navigating the complexities of the loans process can be overwhelming. With restrictions such as limited leverage, specific loan terms, and a multi-step application process, it’s important to have expert guidance to ensure success.

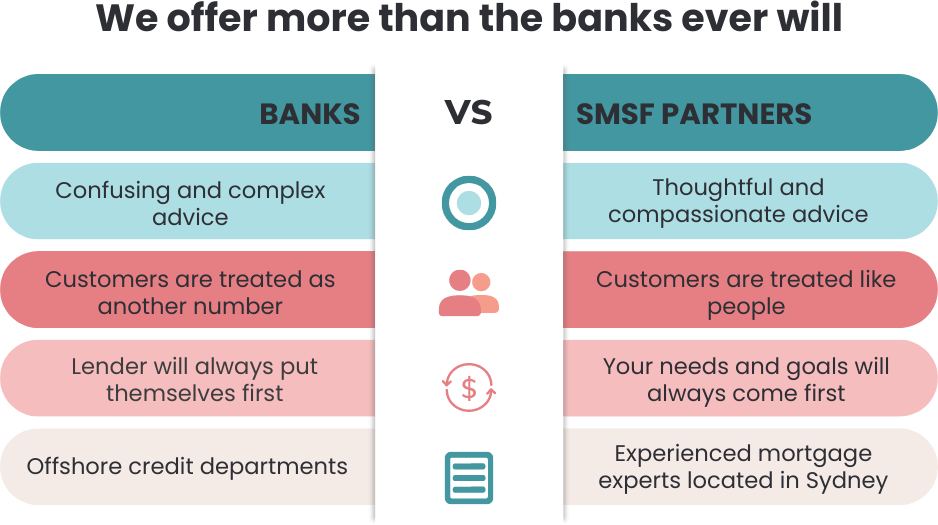

That’s where we come in. Our knowledgeable team simplifies the process and streamlines the approval process, allowing you to take advantage of investment opportunities more quickly and efficiently. Whether it’s residential or commercial properties, we’re dedicated to helping you achieve the maximum profits for your SMSF members and trustees.

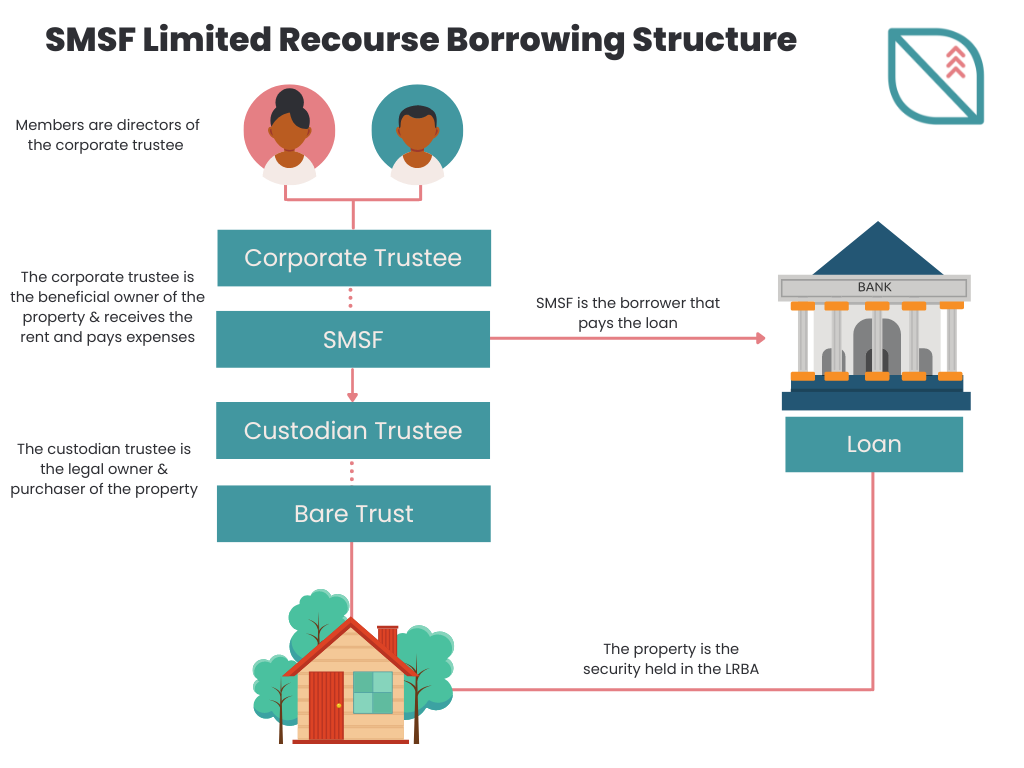

To borrow via this method, a Bare Trust must be established, as well as a Bare Trustee company. The investment property is then owned by the Bare Trust, with the SMSF having a beneficial entitlement to it. The Bare Trust is essentially holding the title until the loan is paid off. After the loan is repaid, the SMSF has the right, but not the obligation, to acquire the legal ownership of the investment property.

The loan application process for a SMSF is not like a typical loan and can be quite complicated. For this reason, we provide an in-house loan service to assist with loan applications to a number of lenders that offer LRBA loans.

Don’t let the opportunity to secure your financial future pass you by. Contact us today for a no-obligation, no-strings-attached chat about your SMSF lending options. Our expert team is here to answer any questions you may have, and best of all, our consultation is completely free of fees and charges.